Intense competition in the retail space has ensured that the customers are spoiled for choices and as a direct result, margins for the retailer has dropped considerably. Imagine a customer walks into the store looking ketchup and sees about 40 assorted brands on the shelves. S/He is most likely to pick the one that has the maximum brand recall, or look for something that is the cheapest or, randomly picks one and drops it in the cart – it’s just pureed, processed tomato pulp after all. Majority of shoppers can be categorized into these three buckets: Loyalist, discount shopper or the impulse shopper and if a retailer is keen on maximizing profits from these profiles, cutting the cost of procuring end products from manufacturers and middlemen would certainly help.

Enter the protagonist: Private Labels

According to a recent study by IRI, private label brand significantly outpaced the industry average growth rate (4.1% to 2.8%). Private label CPG now accounts for over 17% of multi-outlet unit sales and enjoys a nearly 22% unit share in the grocery channel. Seven out of 10 millennials prefer stores that have a wide selection of private label products, and nearly as many (66 percent) often buy private label options over name brands. The appeal isn’t limited to younger shoppers; consumers from all generations view private label as a way to save money and improve value without sacrificing quality.

If you are a retailer and looking to launch your own private label/ optimize profits of your existing label, here’s a 4-point plan to get you kickstarted:

Identify unmet customer needs – No demand, no need to supply. To identify the demand, there are several routes that one can take:

- Feedback from store operations on specific items that customers keep enquiring about frequently

- That specific item that keeps going out of stock no matter how much of it you stock

- Do a market basket analysis of all the items purchased over the last few years to identify maximum SKUs sold

- Analyze search trends and patterns on your website and app

- Feedback and survey analysis of customer sentiments

- Look at competitor labels/ talk to analysts

The foundation for identifying customer needs is, of course, the availability of data and a strong analytics platform that can help you gain insights out of that data. Once you have your analytics in place and reviewed the above items, you have a clear idea about the product line that can be the guinea pig for your private label.

Put your supply chain to work: Traditional supply chain looks at optimizing the supply chain and includes:

- liaising with suppliers to eliminate bottlenecks

- sourcing strategically to strike a balance between lowest material cost and transportation

- implementing just-in-time techniques to optimize manufacturing flow

- maintaining the right mix and location of factories and warehouses to serve specific stores

- using location allocation, vehicle routing analysis, dynamic programming, and traditional logistics optimization to maximize the efficiency of distribution.

Can you imagine the amount of information that is available with all these ‘external employees’ and your internal teams?

Private label means relationships with industrial and product designers, materials suppliers, factories around the world and logistics providers. And all these ‘new’ relationships are within your arm’s reach. Factor in the analysis you did about customer preferences and you can narrow down on the specifics. For example, with the ketchup example, you learned that the loyalists prefer fresh, organic, no sugar ketchup. Conceptualize the product with your design, category managers, and product teams. Get your team to reach out to factories within a 200-mile radius and link them to organic farmers within the area. Identify optimal routes and logistics to the factory and distribution from factory to stores. Put a production and supply schedule in place based on demand and sales forecasts.

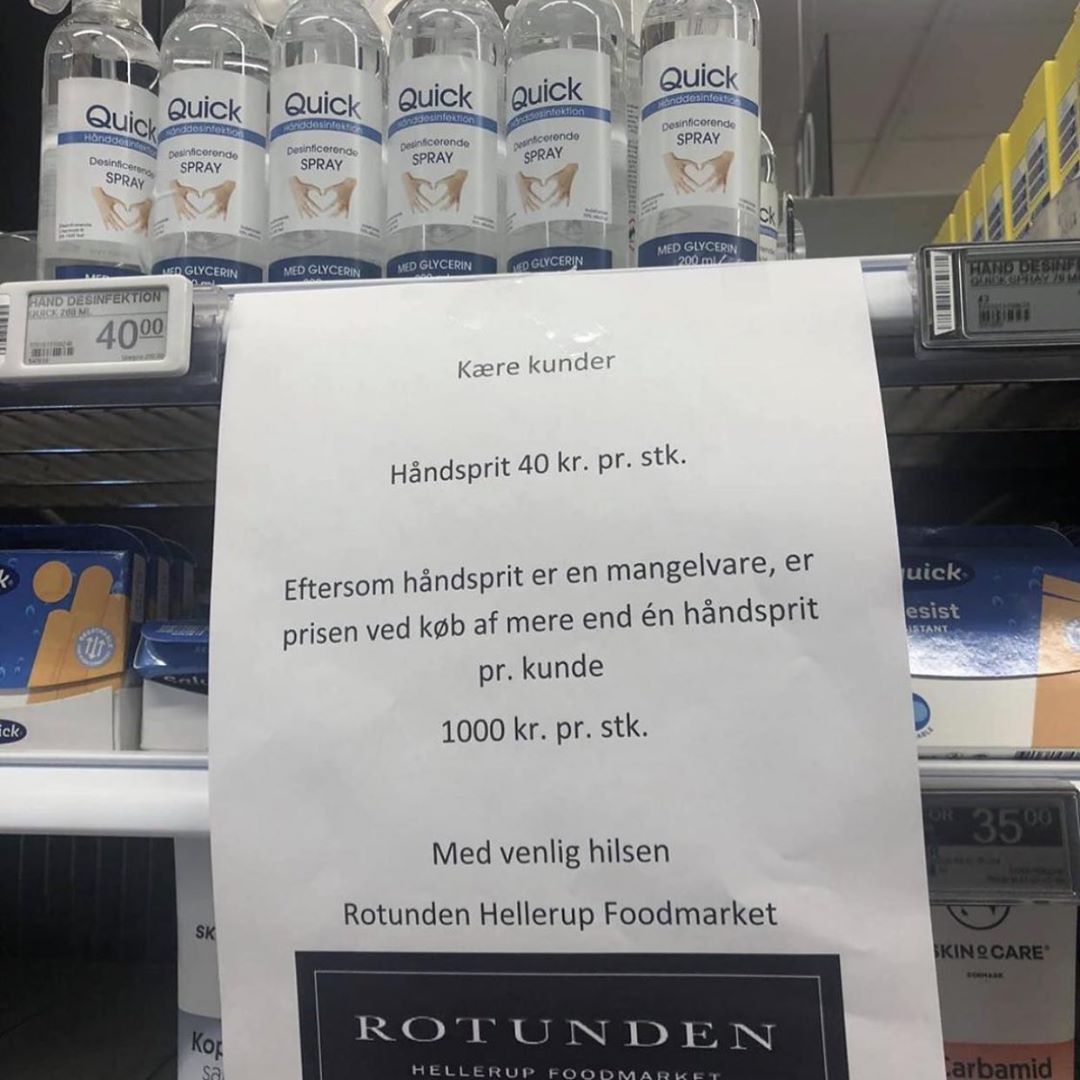

Get the pricing right – Is your target audience a discount shopper or impulse buyer? What are the prices of other products that you are placing right next to this one? What are competitors pricing their private label of similar offerings? There are some top-notch retail solutions out there that aid retailers price your product intelligently by analyzing a variety of factors that impact pricing such as the age of stock, lifecycle stage, inventory count, sell through, demand, competitor price analysis, promotions or bundling. Given that the lifecycle of the product is at a nascent stage, you can, however, take some liberties and take additional factors into consideration further down the lane.

Take your overall costs for that product into consideration, and you’d also want to get a general idea of how that product category is priced. In general, private label products are priced lower than national/ international labels. This is because private label products lack the brand value carried by bigger brands. These brands have earned a reputation and consumers will pay top dollar for that brand value. Private label products have long carried a reputation for being a “cheap” alternative and therefore have weaker brand value.

The key to getting the final price right is to simply let the product present itself to the customer for a set period of time with alternative prices. You can then use algorithms to recommend the optimal price.

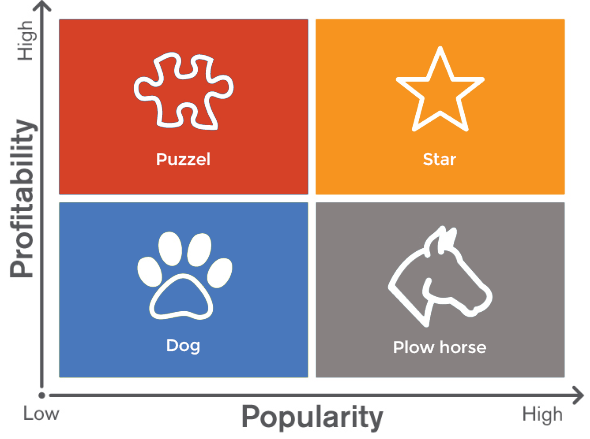

Decide Optimal Branded-Private Label Mix: You must get your category managers involved in this biggie. Category Managers can continually optimize the product mix by recommending products to be dropped, retained, replaced or substituted. They can also identify complementary products that can be bundled based on purchase patterns, linkages and cross-sell opportunities.

The other decision you could make is whether to go with an instore heavy/ web/app heavy placement of your product. Capturing web search data will help retailers make that decision — Are customers searching for a brand or features in a specific category on the site?

Retailers must realize though, that adding additional products into an assortment will eventually lead to cannibalization. While you are heavily invested in making your private label work for you, also pay close attention to which brands are getting affected in return and if it’s worth having the other brand on your shelf.

I hope these pointers give you a good head-start in getting your private label strategy right. In summation, consumers are giving retailers permission to grow their private label brands. The real question is will retailers grow private label brand value or simply grow more private labels? You really know that your private label strategy has worked when the discount and impulse shoppers have been converted into loyalists.

If you are looking for solution providers that can help you with your private label strategy, visit: Manthan.com