Most retailers still lag behind when it comes to utilizing data for transforming the analytical ability and drawing conclusive insights. More than collecting available and obscure data, it’s the acumen of putting it to effective use which is costing retailers dearly. Surprisingly, most retailers are still treading slowly as the process of supplier collaboration is often slow, time-consuming, complex, and delivers slow results. And only those retailers with a keen eye to improving profit margins really put data to work.

The two primary aspects here are collecting possible data and putting it to use.

Data collaboration

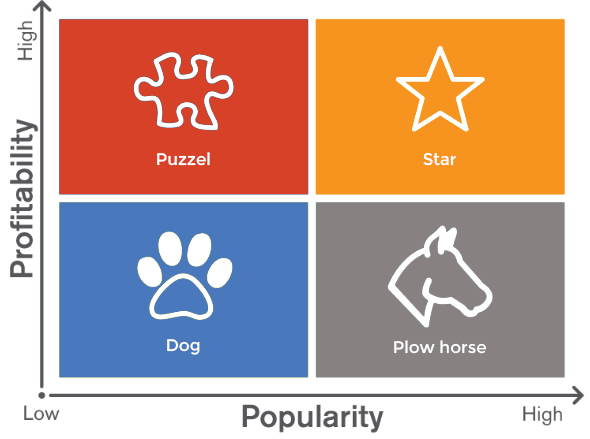

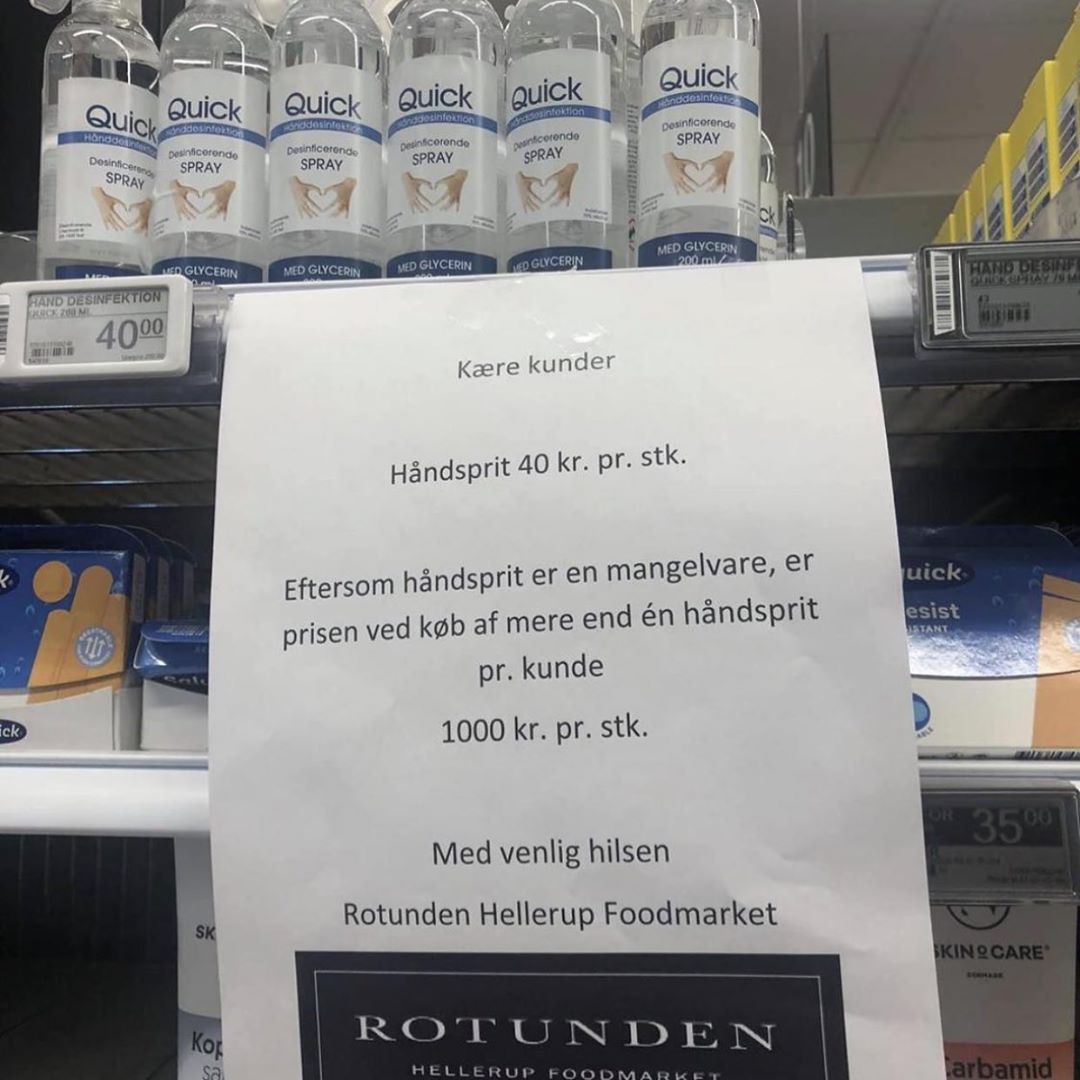

Do not just rely on point of sale data; rather look for details from all possible sources in and around the store to garner information that can truly help. Inventory movement trends, stock replenishment cycles, demand spikes, shopping trends, fast and slow-moving products, product visibility impact, store-help induced sales, gauging impact of promotions, collecting shopper feedback, trend analysis, shopper demographics, periodic sale comparison, order-to-delivery time lag, ordering cycles and return to vendors are some key areas from where valuable data and insights can be extracted. Processes and technologies should be utilized for collecting, storing, and easily retrieving data when needed.

Analytics and action

The retailer has to take the lead in designing seamless workflows and utilizing technologies for integrating and analyzing data. This will offer ready-to-use and valuable insights that can drive the benefit extraction wheel with supplier and manufacturer coordination.

Let’s now look at the fundamental aspect of putting the collected data to full use:

Willingness to share and benefit

A 2014 study on ‘Shared Data’ conducted by CGT and RIS states that 43% of retailers do not share any data with their suppliers. Retailers should step up and look seriously into this and assess the reasons for the lag, which may include an unwillingness to share data, unawareness about added benefits, lack of properly collected data, difficulty in establishing proper data sharing channels, and use of needed technology. It’s time retailers fast track on this to not only increase profit margins but also to heighten shopper experience.

Establishing coordination

Mutual understanding, transparency, and awareness of the benefits can lead to improved retailer-supplier collaboration. This has to have impetus from both the stakeholders as coordination should be established ideologically, methodologically, and pragmatically. The right technology, coordinated processes, and co-strategic efforts can make the process highly tangible.

The ‘what’ and the ‘how’ of sharing

Though ‘what’ and ‘how’ to share evolves from the premise of mutually agreed on terms and processes; it’s the retailer who anchors most of the effort. Retailers should document the quality of data and information exchanged which induced better, palpable action and results. The same stands true for the ‘how’ aspect of sharing data. Utilizing cloud-based systems, centralized data repositories and pre-packaged insights can make the process of data sharing easy. When suppliers and retailers can get the relevant information they need without spending too much time, then the mutual decision-making process will become faster and profitable.

Technology obviously binds coordination, but compatibility of technology among the coordinating members is really important. Though the nature and size of the members define the technology they use, there has to be a common technological platform where compliance is maintained.

Appending your benefit list

More than listing the common benefits of putting data to ideal use through proper collection and sharing, it’s the shift in the way you perceive the benefits of supplier collaboration that counts. The below chart from the 2014 ‘Shared Data Study’ conducted by CGT and RIS shows the top 10 benefits of data sharing:

| 2014 | SUPPLIER BENEFITS | RETAILER BENEFITS |

|---|---|---|

| 1 | Improving on-shelf availability | Lower inventory and safety stock levels |

| 2 | Better demand forecast accuracy | Improving on-shelf availability |

| 3 | Lower inventory and safety stock levels | Improving promotion design, forecasting, and execution |

| 4 | Sensing product acceptance in new product launch execution | Better new product introductions |

| 5 | Improving shopper/customer experience | Improving the shopper/customer experience |

| 6 | Sensing of product category changes | More accurate demand forecasts |

| 7 | Demand insights to drive new product development | Better category management |

| 8 | Improving promotion design, forecasting, and execution | Improved joint replenishment programs (VMI, DSD) |

| 9 | Better sales force targeting and campaign execution | Better store execution |

| 10 | Reduction of demand latency | Improved planogram management |

The above chart clearly shows how priorities can change and this is where sustainable growth comes in. So start looking for useful data, engage the right processes and technology, and start sharing it right away to create a mutual growth story.

Join the Retail Collaboration Network on LinkedIn, and connect with experts and users interested in Supplier Collaboration.