As per a Harvard Business Review report, if shoppers fail to find a product that they are looking for, 7% to 25% of them will not replace it with a substitute and around 21% to 43% of them will go to another store to buy the item. Now this clearly negates the section of retailers who believe that shoppers will pick an alternate product from the same category if they fail to find the intended product. And due to intense competition, retailers also must ensure proper product spread and relevant inventory to prevent empty aisles.

There are three primary aspects to this which need to be addressed by all competitive retailers:

1. Stock movement and performance

Knowing stock movement not only ensures timely inventory but also leads to greater demand estimation which prevents out-of-stock situations. Here are some key points that need to be looked at:

Know your stocks

You have to develop a routine which ensures adequate stock at all times by establishing an effective communication channel with suppliers. You have to look at stock refill cycles, daily point of sale data, demand spikes, on-shelf replenishment practices, daily stock reporting, promotion backed sales, and so on. All these activities must be made into a regular process which can then be easily followed.

An analysis conducted by a group of institutions (Emory University, Goizueta Business School) on ‘Retail out-of-stocks’ found that 70-75% of out-of-stocks are a direct result of retail store practices (either underestimating demand or having ordering processes/cycles that are too lengthy) and shelf-restocking practices (product is at the store but not on the shelf). This clearly mandates the need to develop proper inventory management processes and store practices to avoid out-of-stock situations.

Know your sale

The process of selling involves a lot of variable factors and is also subjected to many targeted activities, all put together, you should be able to estimate the rate and nature of your sale. You have to identify how your products fare at different shelf locations, what impacts the product push at various store locations, ratio of sale difference between regular, weekend, festive and promotional periods, and so on. Once you start looking for these details you will begin to finely conclude on the nature, ratio, and rate of sale at all times. This is really crucial to always keep your aisles filled with products which your shoppers demand.

Know your products

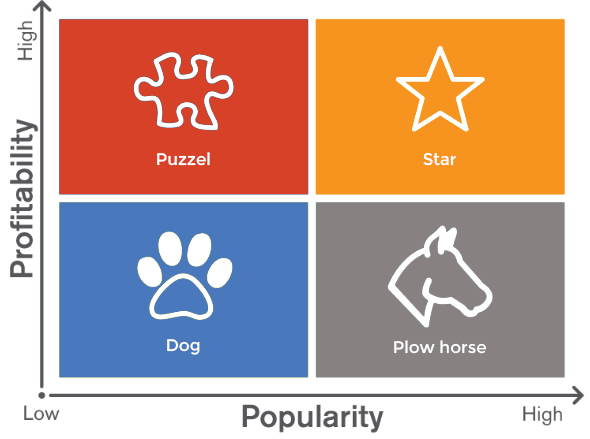

The obvious off-shoot of knowing your sales performance is knowing how your products perform in various categories. Looking at point-of-sales data gives you an overall picture of sales and inventory status but analysing it leads to proper understanding of performance of your products. This analysis will lead to identifying aspects like most demanded and least demanded products, impact of promotions and festive occasions on most and least demanded products, identifying self-sustaining and promotion based products, and so on. Now if you start looking at these broadly you can easily conclude on product priority and stocking priority, you can also look for more suppliers to support additional demand for products based on your priority list.

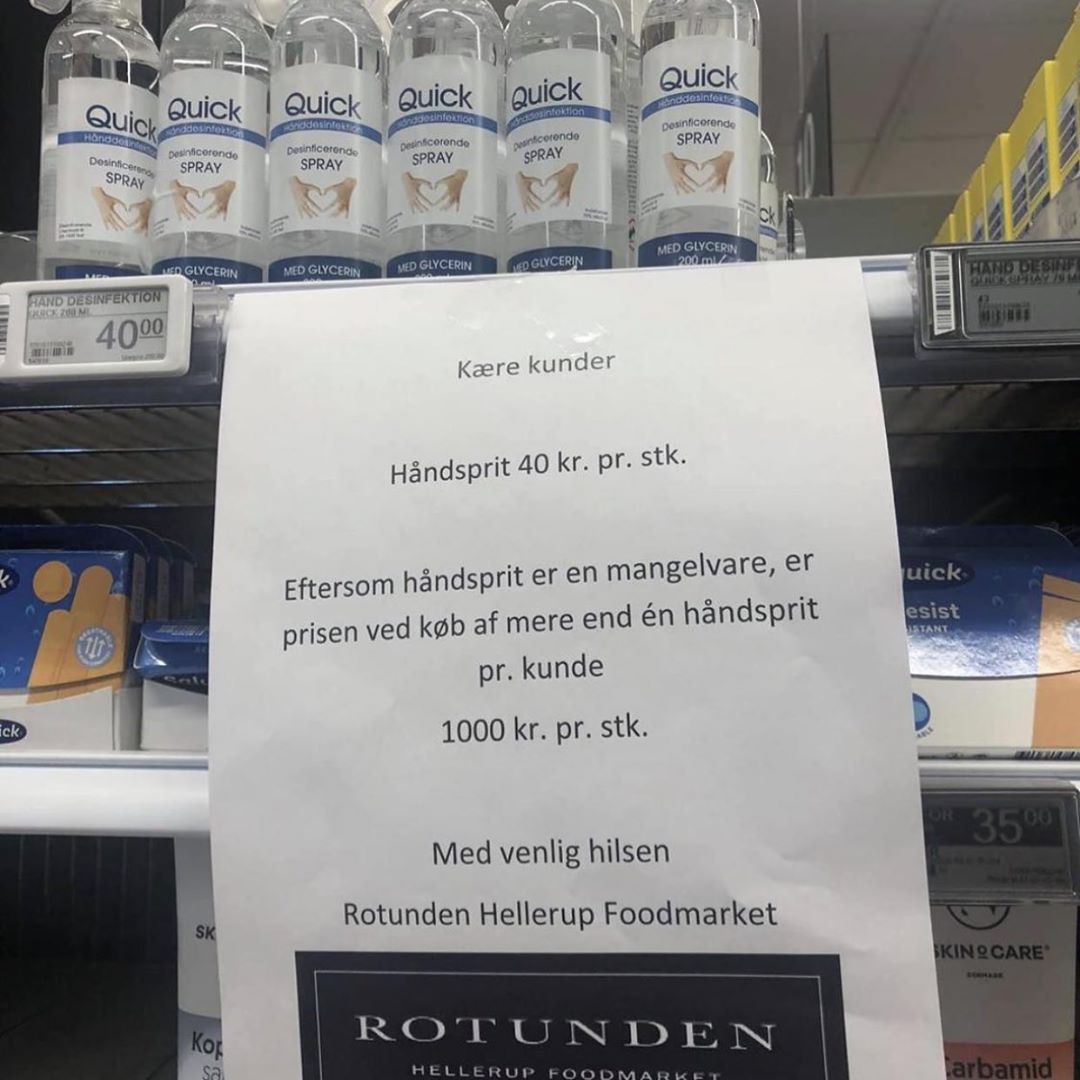

2. Promotion and marketing impact

Apart from the general demand spikes backed by promotions and overall marketing campaigns, as a retailer you should assess the true impact of the promotions. For this, you must get a broader estimate of the average industry sale expectation for every promotion and compare it with the actual sale made. If possible, you can also cross verify competing store’s promotion backed data and look for differences. If there is a marked negative difference from the average expected sale then the need to look for in-store issues like out-of-stocks, poor visibility, ineffective promotions, etc., need to be looked at. And if you have exceeded expectations you have to identify aspects and processes which did it for you. These could be better supplier responsiveness, smoother supply chain, right inventory, better visibility, and so on. This approach, over a period, will give you key performance indexes to lift your sales and anticipate early stocking.

3. Collaboration with suppliers

Nothing converges without supplier collaboration. Retailers can achieve optimum product stocking, estimate promotional sales, identify overall product performance, improve refill cycles, do demand forecasting and develop smarter stocking processes if they work coherently with suppliers. Retailers have to consider suppliers as their extended arm, and vice versa, for preventing empty aisles and also preventing overstocking at all times.

As a retailer you can reduce cost of inventory with real-time inventory flow based on process and analytical collaboration with suppliers, and thus, reduce out of stock situations. By identifying the key performance indicators and constantly working on them, you can increase your sale and shopper loyalty. Retailers and suppliers can achieve clarity of supply cycles, avoid unnecessary trips and overstocking at both ends, improve distribution and prepare for trends with reliable demand forecasting.

Conclusion

Establishing coordinated processes with your supplier network can bring out the obvious advantages of optimizing inventory and preventing empty aisles. This calls for building collaborative models, enabling intelligent technology, avoiding petty haggling, and creating a win-win environment which delivers significant benefits across the supply chain.

Join the Retail Collaboration Network on LinkedIn, and connect with experts and users interested in Supplier Collaboration.