In modern parlance, an industry-wide disruption isn’t inherently a negative thing; in fact, it’s often exactly what’s needed to raise standards, drive innovation, and move past outdated views of how certain businesses should function.

Just as it has disrupted many other elements of retail, it’s inarguably the case that the online ecommerce model (so greatly polished by juggernauts like Amazon) is rapidly changing how we approach the sale of Consumer Packaged Goods (CPG).

CPG were among the last holdouts from the old brick-and-mortar retail standard, but the times keep moving on. Let’s look at specifically how the CPG sector is changing.

Offline Retail Is Getting Connected

If you look to the top of this piece, you’ll see an Amazon Go store, described as “a new kind of store with no checkout required”. Essentially, you venture into the store, pluck the items you want from the shelves, and walk out; along the way, your Amazon account is identified, the items you take are monitored, and you are charged accordingly.

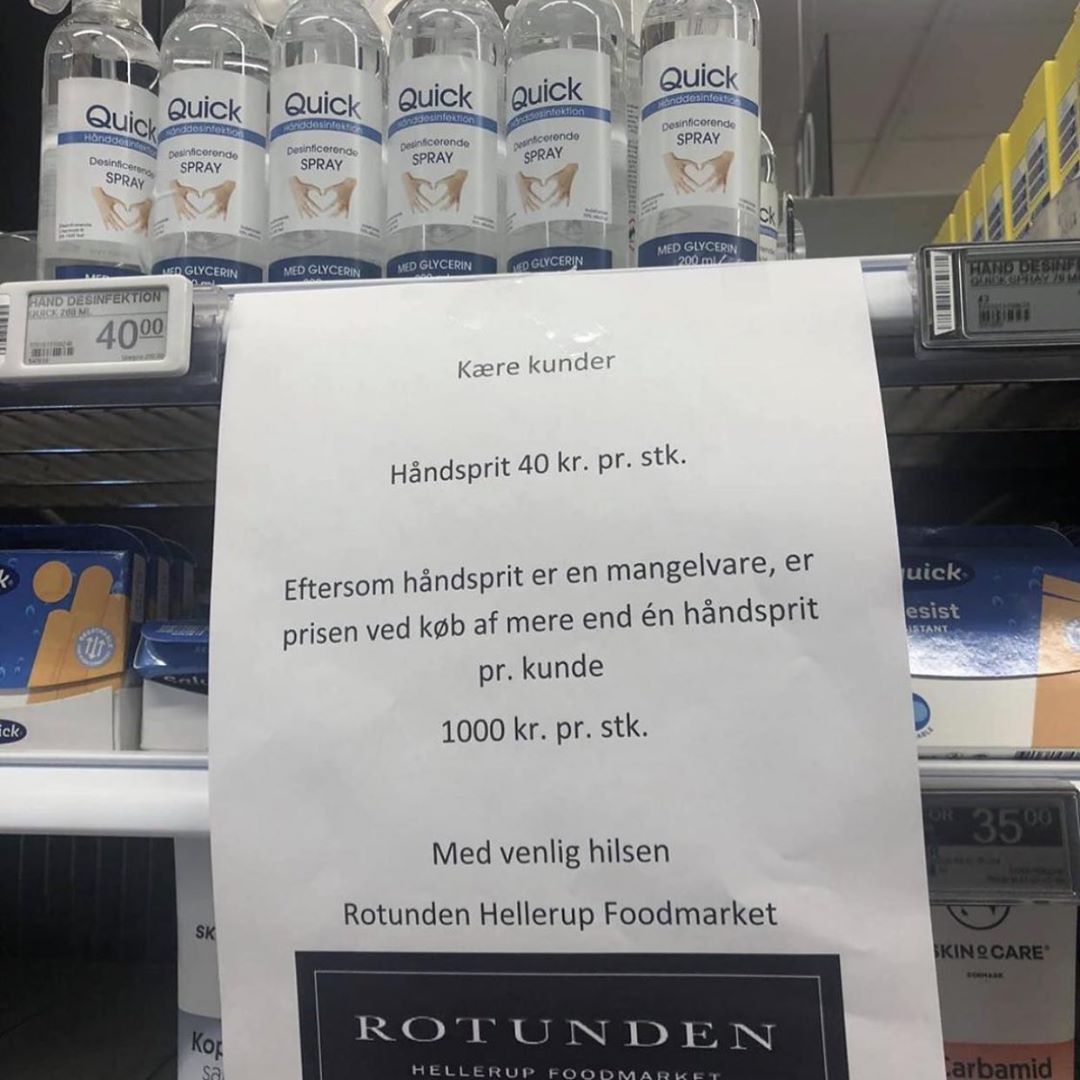

This kind of store is still very much in the prototype stage, as the potential problems abound. What if the internet connection goes down? How will theft be prevented? How will retail jobs be affected, retained, or adapted? Will people be willing to have everything they buy from a store be connected with an online account?

But there’s every reason to think it will become standard sooner or later, especially when they begin to financially incentivize it. Retail will be of the ‘order online, collect in store’ variety across the board, and consumers will have more options than ever before.

3Competition is Heating Up

The CPG sector has long been dominated by a select group of huge brands— those with the funds and distribution networks to get their goods in every major store and saturate promotional avenues to the extent that consumers would automatically trust them.

For examples, think of Coca-Cola, Heinz, or Hostess. There has always been room for store-brand and locally-sourced goods alongside them on shelves, but such goods have rarely had any realistic hope of being truly competitive with them. Now, things have changed.

These days, several factors combine to make it drastically more achievable to compete with (and in some cases outperform) top brands:

- Social media makes steady growth possible on little to no marketing budget.

- Without TV, radio or banner ads, growth used to be all but impossible. Today, word-of-mouth recommendations abound through social media, and a brand that masters the various platforms can drive sales without much of a budget.

- Technology has greatly lowered the investment required to sell goods.

- You don’t need a physical store; you can operate entirely online. You don’t need experience; you can learn as you go. Comprehensive ecommerce solutions not only make it quick and cheap to build online stores— they can also help you get products built. And it’s even possible to sell without having a store.

- Meeting demand for options requires flexibility and maneuverability.

- The larger the ship, the longer it takes to change direction. The agile nature of small companies allows them to rapidly adopt new tactics to suit shifting consumer preferences and trends.

In many ways, the playing field has been leveled, and though brand recognition is still very important, it has changed significantly from a question of “Which brands reliably meet my expectations?” to “Which brands are doing the things I like right now?”.

Subscription Goods are Flourishing

Tying into all the factors we’ve looked at thus far—and following the push towards smart and expedient retail processes—the subscription model has swiftly come to dominate a variety of CPG categories, and its popularity doesn’t seem to be waning.

Instead of heading to superstores to choose items one by one, people sign up for regular deliveries of curated products following particular themes. Healthy snacks, grooming products, varied collectibles; it feels as though there’s a subscription service for pretty much every type of consumable, comestible or degradable product out there.

It’s particularly interesting to examine because it shows just how differently we value things in the digital era. We generally know we’re not getting the best prices on items through subscription boxes, but we like the convenience, and the fun mixture of unpredictability (what exactly we’re going to get) and reliability (the rate of delivery).

Presentation Points are Moving

Go to a huge retail outlet and take a look at the attention paid to the packaging: glossy boxes, stands, leaflets and banners. Everything there has be not only designed but also produced and distributed, just like the products themselves. Many items will have complex and nigh-inaccessible plastic encasements.

Then look at the average branded delivery package. Relatively plain cardboard, perhaps with some padding inside. There will be a large logo, the company name, and possibly an adherence to the brand’s color palette, but otherwise there won’t be a great deal of difference in external appearance from one box to the next. It’s all very pragmatic.

After that, go ahead and open one of the subscription boxes; you’ll likely find some kind of added value in the form of a personalized card, a discount voucher, or a small toy. The companies know that connecting with the customer after the point of sale is important, even for relatively low-cost products. Brand relationships are very valuable in the long run.

I find it quite easy to imagine a scenario in which stores like Amazon Go become standard (as other retailers will certainly need to up their game in response) and customers browse through colorful product images on digital displays before collecting the actual items in the form of generic brown boxes holding personalised contents. It definitely provides a lot of food for thought when it comes to marketing CPG.

Ecommerce has never really been restricted to high-ticket items, but it’s only through outstanding levels of efficiency and automation that it has finally become a major disruption to the CPG world— and there’s no going back now.

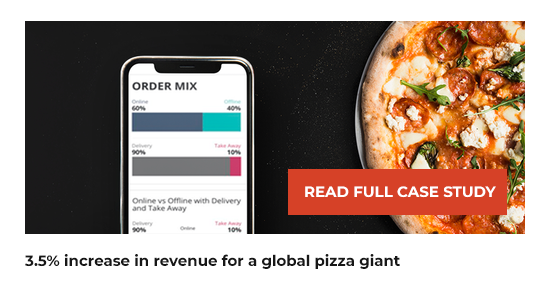

For retailers to survive, and thrive, they need to understand the data behind consumer actions and optimize accordingly. Manthan’s analytics-driven solutions for everything from stock control to customer need analysis can help you adapt with the times.