No matter how well you understand the subject and all the formulas, equations and algorithms that go with it, having the ability to predict something that is going to happen in the future is cool!

If I had to make a pop culture reference to how someone can really control outcomes by making changes based on data, I would quote Moneyball. The movie that really made sabermetrics a household name and showed audiences how the ‘back office players’ really change the result of the game. Traditionally, a scout would assess which player has the potential to positively change the outcome of a game based on experience and ‘gut feel’. More scouts had failed at their job than the good ones that made it (with a whole lot of lucky guessing). The movie showed that if you took the human factor out of the play and looked at facts based on solid data, algorithms can make better predictions on who should be playing the next game.

As machine learning, deep learning, artificial intelligence, etc. become mainstream words that are taught in primary schools these days, it pays to fully understand how the system truly makes predictions and prescribes actions that a business should take. In this article, let’s look at how churn models and propensity to buy models can help you ‘moneyball’ your data.

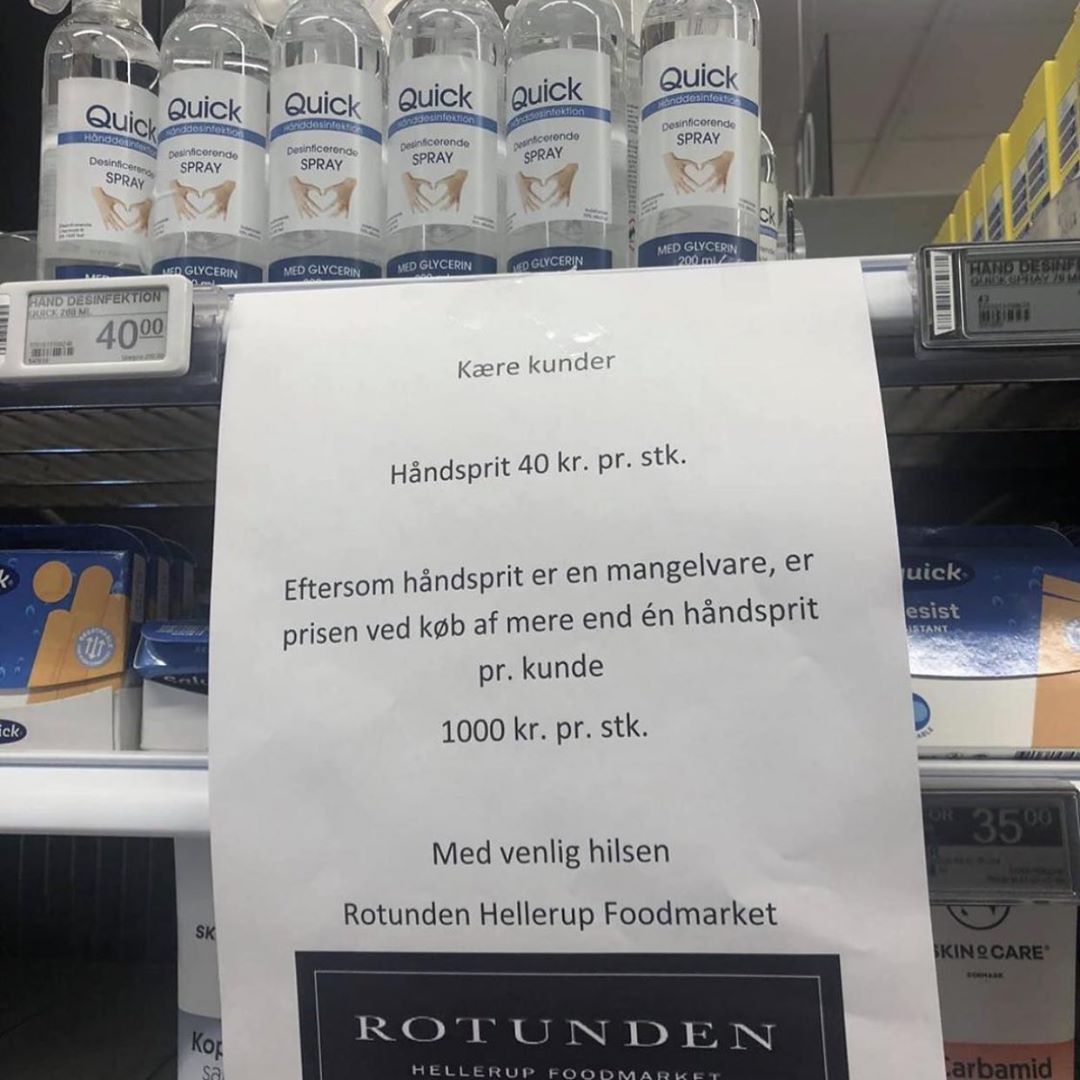

First things first, to ‘moneyball’ your data, you first need to have data. It can be anything from sales data, customer demographics, visits, social profiles, customer feedback, etc. This data forms the basis for your models to get trained on is called ‘training data’. Models and algorithms are either pre-built or can be customized for a specific use case. For example, if you want to understand which segment of customers are going to churn in the next quarter, you can build a churn model which denotes the probability of a specific customer/ set of customers as a percentage. You can then get an output along the lines of: ‘Top 100 customers that going to churn in Q2 18’ and use that report to engage the customer better.

How does the model arrive at this percentage?

Much like how Darwin looked at the animals in Galapagos island to understand evolution, the model looks at the ‘training data’ to understand underlying patterns in past interactions. For example, the model could look at no. of calls made to the call center, emails sent to the helpdesk, ratings posted about products and drop in visit frequency to the site or store in the past 3 months and understand that every time a customer does all four, it is most likely that the customer is going to stop buying from you. This then gets converted into a percentage and let’s say that a specific customer did just 3 of those as opposed to all four, he gets a probability of churn % as 75%. Advanced models can also allow you to apply weight to specific attributes, like: A person who gave a low rating to a product gets a heavier weight as opposed to someone who did not visit the store in x amount of time. This weight can get you closer to predicting the likelihood of customer churn analysis. The more attributes you are adding to the churn model, the better.

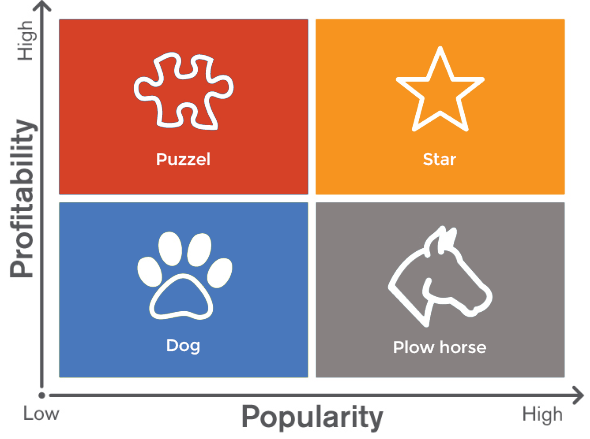

So how does a propensity to buy model work? Similar to the churn model, it looks at past behavior, attributes, demographics, sales data, etc. of the best customers in your training data that you want more of. For example, there is a set of thousand customers that are your real cash cows and spend $1000+ on your merchandise every month. This becomes the protagonist that you are going to refer to and compare the rest of your training data set with. Let’s say that one of the patterns that the model detected was that majority of the customers that bought $1k+ merchandise were loyal to one specific brand in your store. This purchasing pattern becomes a base for you to start marketing to others that have bought that specific brand but are in the $700 per month bucket. (What do you market to them? Look at the basket of the $1k+). This is just one example. Propensity models can slice and dice your data to look at attributes, behavior, and patterns that might be so counterintuitive that a human can never see a connection between them.

The advent of AI and machine learning has really skyrocketed the applications of churn predictive models. Models have evolved from merely testing a hypothesis to systems that can offer prescriptions and take corrective actions. Several mounting ingredients promise to spread prediction even more pervasively: bigger data, better computers, wider familiarity, and advancing science. But the biggest evolution that churn predictive models are seeing is its democratization. Business users no longer need to depend on data scientists, analysts and IT to assist in decision making. They can now use and deploy these models with analytics providers making it super easy to drag and drop segments and ask pointed questions.

You no longer need to understand the subject and all the formulas, equations and algorithms that go with it. With the help of churn prediction model, the customer churn analysis can be done by everyone and everyone can now do the customer churn prediction to know what is going to happen in the future. And that’s pretty cool!