The global fashion retailing market is valued at 3 trillion dollars, 3,000 billion, and accounts for 2 percent of the world’s Gross Domestic Product (GDP). In recent years, increasing vertical integration and the relentless rise of online sales have created fundamental structural shifts in the fashion retail industry. Classical players are now realizing the potential that e-commerce brings to their business and predominantly e-com players are looking at newer ways of fulfilling customer needs. Read Prime Wardrobe. Economically, we see several trends shaping the industry, including fashion’s response to intensifying volatility, continued challenges with production hubs like China/Philippines, and the rise of urban centers. But the tectonic shift that the industry has seen in the past decade is the shift in consumer behavior. Traditionally, fashion retailers, be it high end or mass market, have relied on their products to ‘sell themselves’ and to a large extent, have relied on ATL advertising and seasonal sales to bring in the moolah. With an overcrowded market that is craving for the customer’s attention, do you think this model will sustain?

There are several players that are looking at newer, smarter ways of engaging customers. Be it virtual fitting rooms or virtual stores even, VR is definitely making its presence felt. With the forecast for 900M AR-enabled smartphones by the end of 2018, the fashion retail industry is forced to rethink how it creates, showcases and retails its products. Oh, the glamour of fashion shopping!

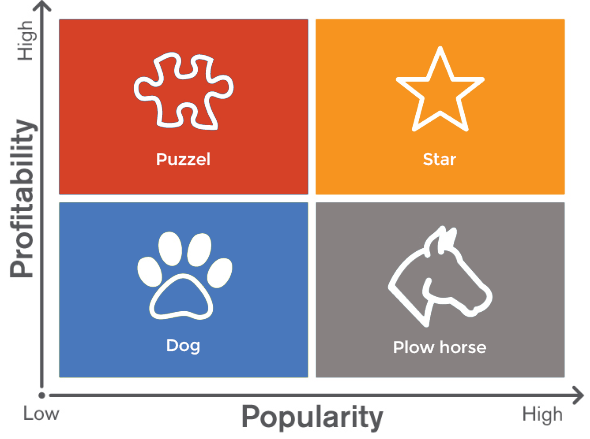

Current market analysis, however, suggests that almost 95% of fashion retailers are looking at solving existing challenges and are bullish on solutions that help them solve existential problems and are bearish on AR and VR. These ‘existential problems’ can be broadly classified as:

- Carrying customer centric merchandise based on tighter forecasts, accurate merchandise plans, brand preferences, and shopper + location specific demand.

- Fixing inventory challenges through real-time inventory visibility, effective inter-store transfers, MBQ resetting for greater sales and inventory efficiency.

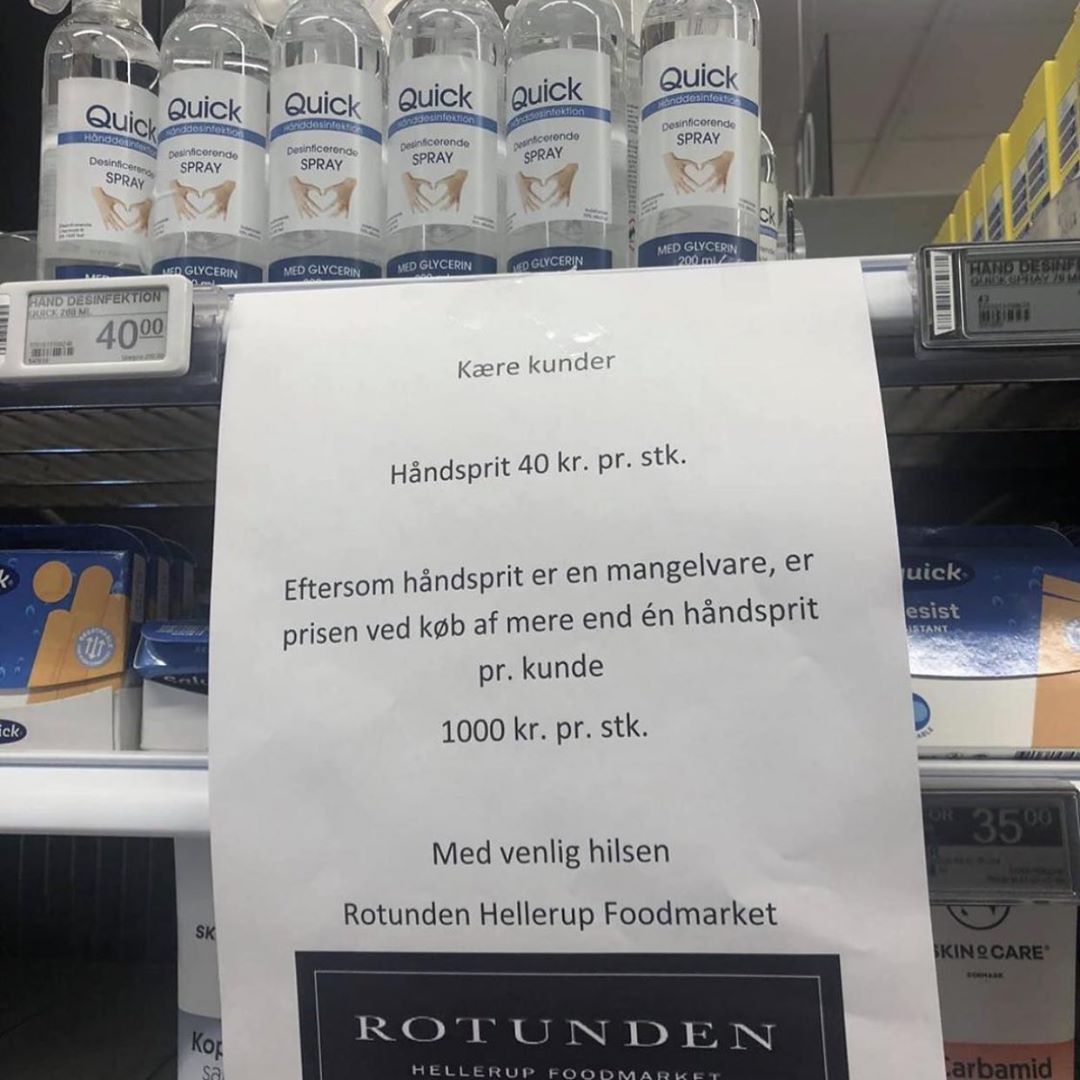

- Automating pricing and promotion decisions optimal price-offs that meet sales targets, maintains category profitability and predicts change in demand due to price interventions.

- Effectively engaging the omnichannel customer that is influenced by trends online, prefers to read reviews, walks in store but looks for information on the mobile, wants offers, discount notifications, and communications to be personalized and makes a purchase decision anywhere and at any time.

Retail pundits have long been crying wolf about the convenience that online retailing giants are bringing to the fashion retail industry and the threat that comes with it. Well, the wolf is finally here. And it’s massive.