Maintaining safety stock is a standard practice to ensure that retailers are cushioned against time lag or delay in the replenishment of cycle stock. Retailers’ warehouses are filled at least 1/10th over the brim, in the apprehension of supply-chain bumpy-rides. This is more so in case of perceived fast moving items. Obviously, retailers walk the double edge of maintaining sufficient stock while running the risk of inventory going stale if the sales do not match the projections.

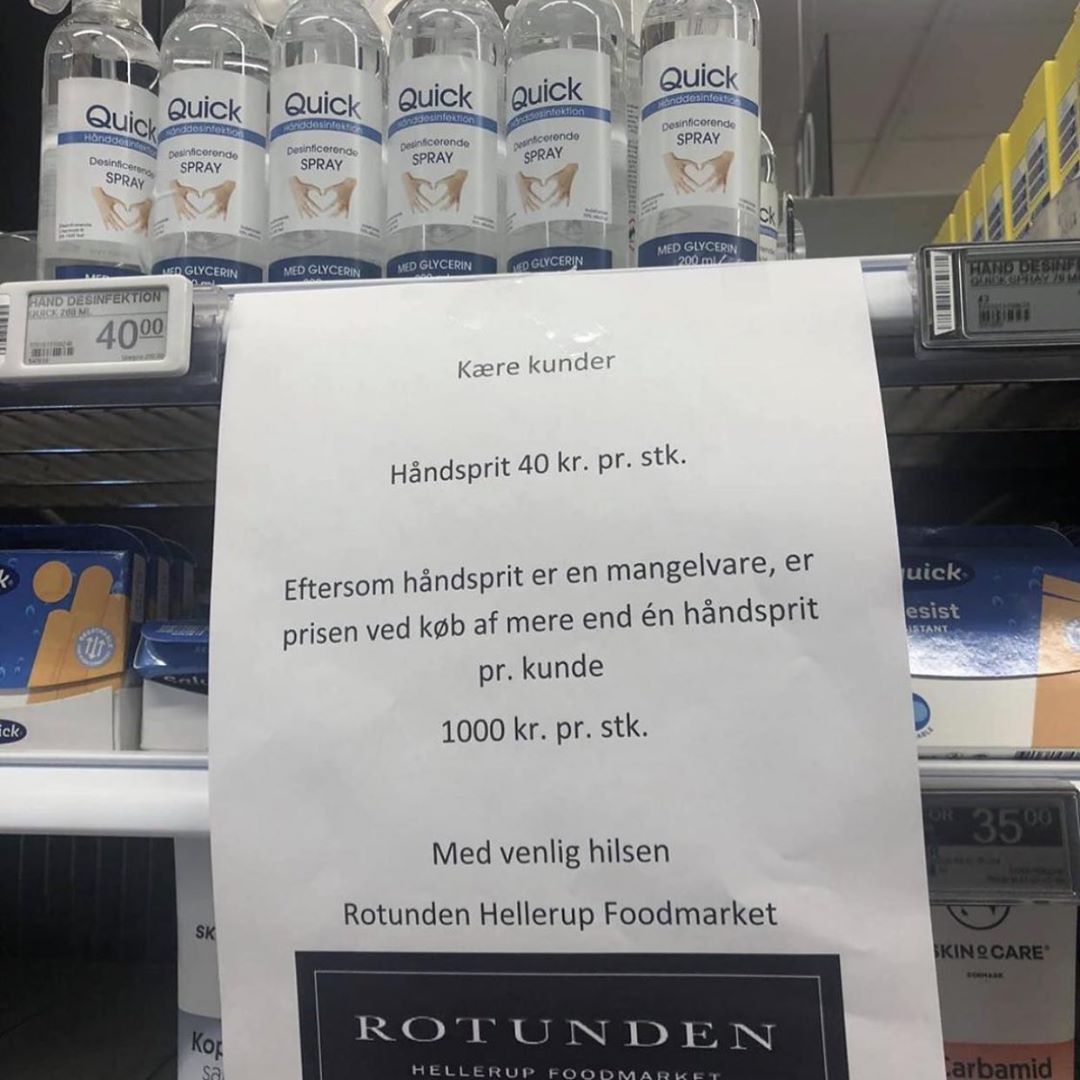

‘Out of Stock’ is a sign retailer hate as it brings down sales and worse yet, pushes the customer to competitors. Suppliers too would like to be ready with stocks when they know their product is doing well in certain stores and not let it stay holed up at the back of the store where the product has not taken off!

Managing safety stock is a tricky game for both suppliers and retailers. Not only does it hold up cash and already scarce warehouse space, it often forces merchandisers to go for unplanned markdowns. It is a logistical nightmare and managing the extra stock can create undue pressure on merchandisers and category managers. Better demand forecasting and inventory management aided by factual data, can not only release the pressure on the managers but ease out cash flow as well.

The crucial question is how to maintain a balance, especially when considerable lead time is involved in replenishments? Streamlined information exchange and real-time visibility of inventory to both retailers and suppliers have nailed the issue squarely and decisively. So much so that Gartner predicts in less than a year as much as 2/3rds of profiting retailers would have moved to platforms providing analytics-driven stock predictions and visibility.

Knowledge of how each SKU is performing under each category in different stores, say during a promotion, can make a huge difference in building an agile and effective supply chain. Real-time actionable retail insights are key here as historical data is not always accurate in predicting demand and category performance. For example, just because Red Scarves did well last summer, does not mean that they will win customers once again, this season. Rather, if the data shows that there was a strong demand for floral motifs in the opening week of the season, retailers will be better prepared to stock accordingly and run the promotions. But in case of retailers had added a considerable safety stock on Red Scarves in their inventory, merchandisers would be forced to sell them at a discounted rate to clear the holed up stock!

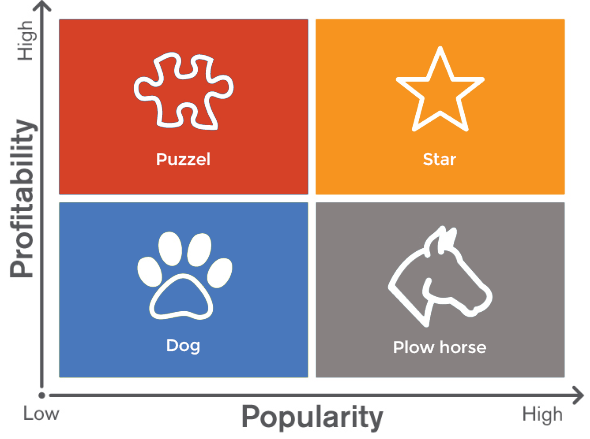

Outdated stock and out of stock, both can derail the customer experience and may work adversely on the retailer’s reputation and goodwill. With real-time visibility on what products are winning customers’ approval and at what rate, retailers can manage inventory better. Similarly, the suppliers can use the insight to improve their demand forecasting and accordingly optimize inventory. The real-time visibility of product performance can also help them make informed decisions on slow and fast moving products and even analyze the response to the new products while beefing up distribution.

Keeping a huge buffer stock, apart from cycle stock is no more advisable in the view of the complexity of customer preference and volatility of demand. Insights that lead to instant action may well be the key. The choice is yours.

Join the Retail Collaboration Network on LinkedIn, and connect with experts and users interested in Supplier Collaboration.