The power of Big Data analytics is turning data into action. Both the brick and mortar and e-retailers are finding their ways and means to capture the shopper imagination. Even now the traditional US retail outlets account for almost 90% of the sales. As shoppers and their behaviour evolve retailers will need to rely heavily on data analytics to understand the nuances of how to influence or activate shopper demand. The manner in which e-retailers personalize their offering to individual shoppers is already a game changer when we compare the brick and mortar with e-retailers. But the traditional retailers have also realized this weakness and have found their way out. The success of the traditional retailers will depend on how they utilize their data analytics to understand the demographic of the shopper profile, how they partner with their suppliers and how they provide the right shopping experience at retail outlets.

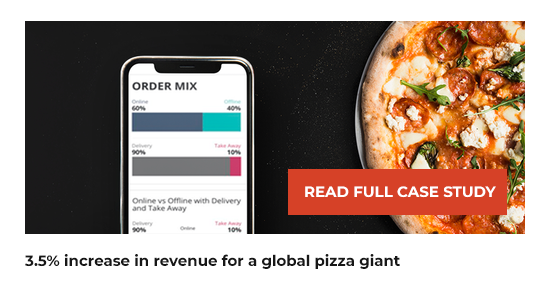

Dissection of Loyalty, POS and Panel data has provided deep rooted insights into the shopper profiles that the retailer can use to drive offers and coupons. Retailers have come up with promotions where, as soon as the shopper walks-in, an app provides the offers on the most relevant items for that individual based on his previous purchases. Data analytics has made this a reality. The success of a data analytics platform will also depend on the data feeds, cleansing mechanism, algorithms, modelling technique and other aspects which need to be mapped with the real and changing envirnment. Retailers, like Walmart and Kohl’s, analyze sales, pricing, economic, demographic and weather data to tailor product selections at particular stores and determine the timing of price markdowns. In an interview in 2013 with, Karem Tomak, vice president of analytics for Macys.com, admitted that just three years ago the department store relied on Excel spreadsheets to collect and make sense of consumer data. Now the retail giant credits Big Data and analytics with a double-digit percentage increase in revenue. Shipping companies, like U.P.S., mine data on truck delivery times and traffic patterns to fine-tune routing. The usage of Big Data is not restricted to only Retail/CPG environments but it has already expanded to other business verticals.

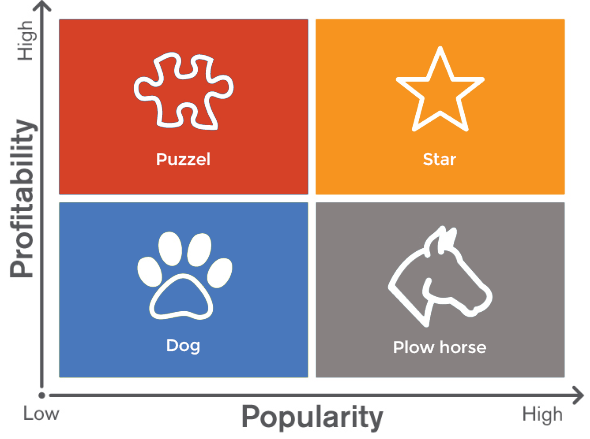

Partnering and collaborating with suppliers is the next big element which can really make a significant impact on the retailer’s topline. Deals/Promotions, Space, Product, Supplier, Order Management can all be driven under one platform and that’s the magic of Analytics. When we combine all these functions, the next big question comes in terms of how we build the story and how do we assimilate or make insights more actionable. Proactive planning of promotions with suppliers will really make a great difference in sharing the success or failure of a plan and make it more accountable.

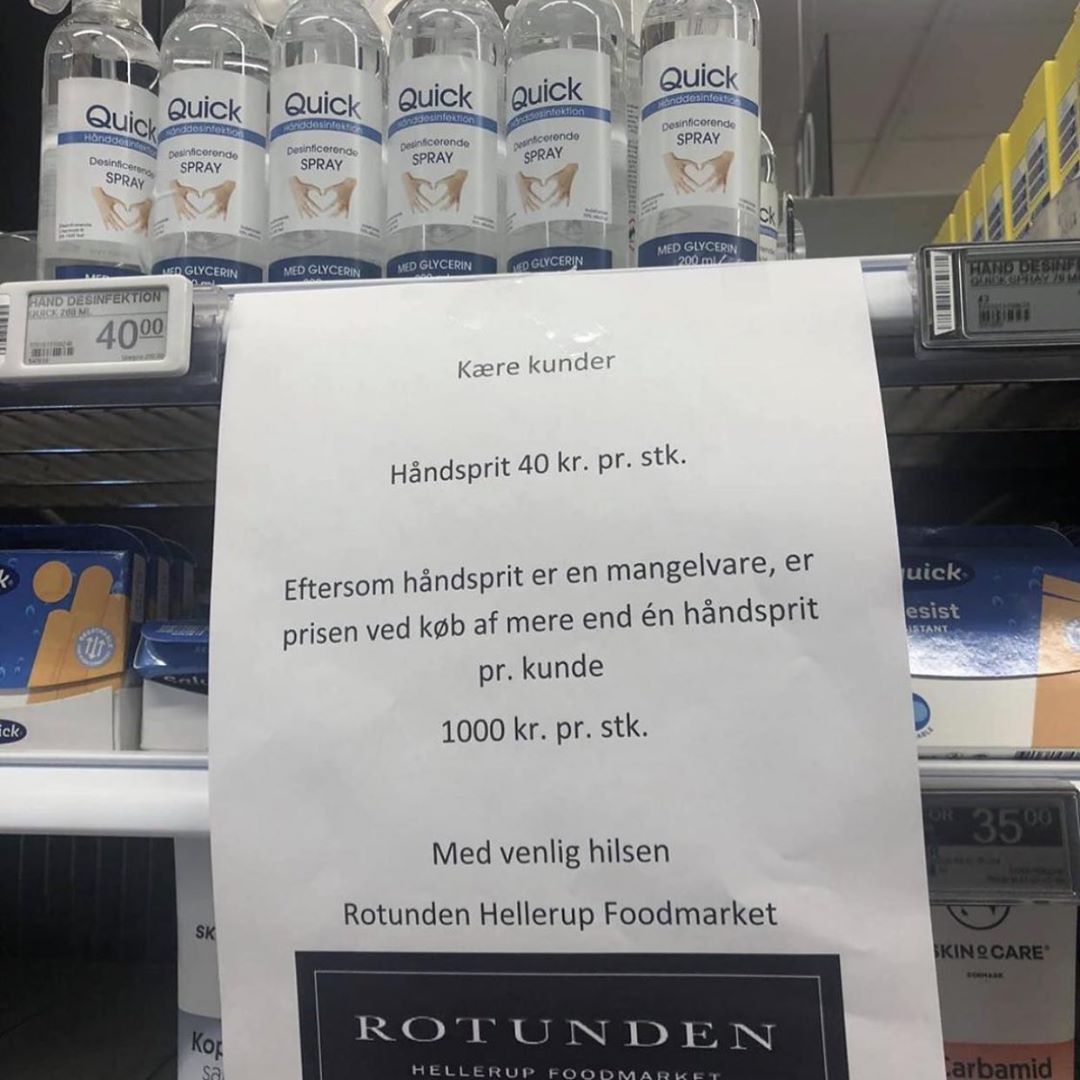

The third element is enhancing the shopping experience at the retail outlets. The way brick and mortar retailers can turn this into a differentiator is by transforming the shopping experience as a celebration. “Surprise the Consumer” – There could be 5 lucky random consumers who could win a $500 dollar store coupon. “Look and feel for your consumer” – if someone is really scrambling in your store purchasing last minute items for party at home or if there is an old lady finding it difficult to shop, seize the moment and provide a helping hand. You have already made a huge emotional connect driving this initiative. These are softer elements that the retail environment can provide through its in-store personnel.

There is plenty of anecdotal evidence of the payoff from data-first thinking. The best-known is still “Moneyball,” the 2003 book by Michael Lewis, chronicling how the low-budget Oakland A’s massaged data and arcane baseball statistics to spot undervalued players. Heavy data analysis had become standard not only in baseball but also in other sports like Soccer, Formula 1 etc. So this is the moment for the retailers to capture the shopper imagination.

Join the Retail Collaboration Network on LinkedIn, and connect with experts and users interested in Supplier Collaboration.