As you swing your SUV out into the highway for a long road trip, it is customary to check your car’s dashboard for critical indicators – fuel, speed, airbag and oil pressure details you will need to control for a smooth journey. The dashboard not only alerts you of things that go wrong during the drive, it also offers early-warning signals such as check engine or fasten seat-belt to draw your attention to potential problems.

Vendor scorecards, much like your car dashboard, provide you with critical information on your suppliers businesses and alert you to problems in your supply chain. They assimilate information from different parts of your retail enterprise and present it to you in a compact and easy-to-understand manner, highlighting where your supply chain is doing things right and where it is falling short. Designed comprehensively and used effectively, vendor scorecards can help retailers measure, monitor and manage supplier performance, foster long term supplier relationships and align supply chains to business goals.

Supplier Performance critical for achieving Supply Chain Excellence

Until recently, retail industry practitioners regarded supply chain efficiencies as an effective means to control costs in the retail business. It helped retailers to reduce operating costs, manage lean and efficient value chains, reduce waste, optimize resources, reduce inventory and improve margins.

However, today more and more retailers are looking at supply chains as a means to build competitive advantage. This makes it necessary for them to foster strategic, long-term partnerships with suppliers. Retailers like Seven-Eleven, Amazon.com, Dell, Zara, Marks and Spencer, Walmart and Li & Fung have been leveraging their supply chains to support business expansion, increase profits, enhance customer service & loyalty and improve market share, revenues and shareholder value. Strong buyer-supplier co-ordination, pervasive collaboration at every level in the supply chain and Joint Business Plans are an essential requirement to building supply chains that reinforce your edge in the market.

Vendor Scorecards An Essential Tool-kit for Supplier Performance Management

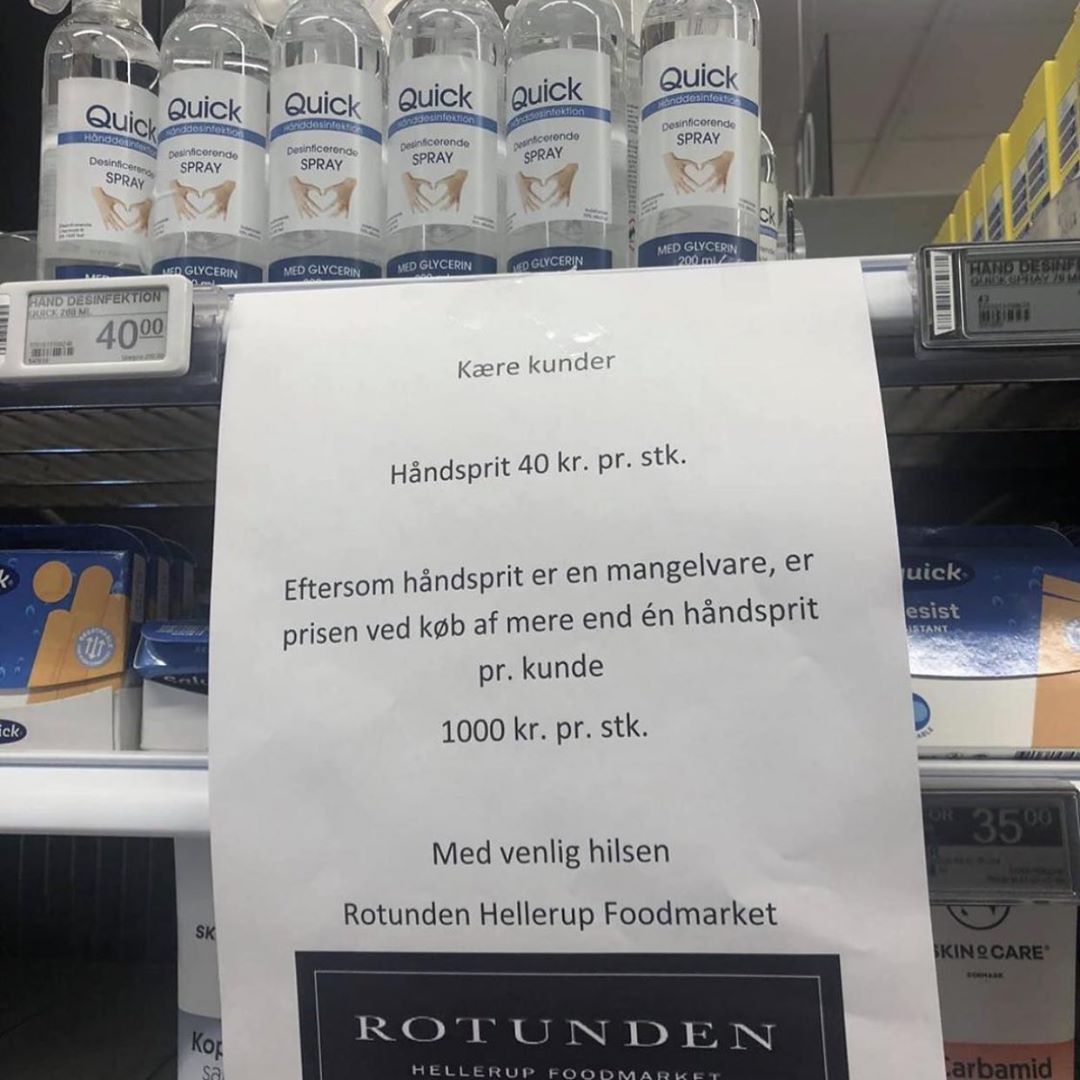

Most retail businesses, until recently, relied on retailer compliance requirements to monitor and manage supplier operations and supplier performance. Suppliers who fail to adhere to these compliance requirements or deviate from them are levied a deduction or chargeback on their invoice by way of a penalty for non-compliance. In some instances, vendors may be fined upward of 10% of the purchase order’s value. As is evident, such an approach may track how well a supplier is adhering to short-term, tactical compliance requirements but fail to provides a complete picture of supplier performance nor foster collaborative supplier relationships.

Scorecards serve as a performance measurement tool that summarizes a supplier’s Key Performance Indicators (KPIs) and metrics and provides a dashboard of supplier performance across critical business parameters. Scorecards help to transfer retailer-supplier relations to a more structured and systematic ground, offering you concrete metrics to base supplier reviews on, develop Joint Business Plans and collaborate for mutual long-term benefit.

Vendor Scorecards in the Retail Industry

Vendor score-cards are a relatively new concept in the retail industry. According to a Gartner report, not all retailers have scorecards, and not all scorecards cross all categories or supply chain processes. Only 55% of volume flowing from a supplier to a retailer is measured by a scorecard. Likewise, only 20% of scorecards shared by retailers with suppliers get past the CP sales account teams to drive change in supply chain behavior.

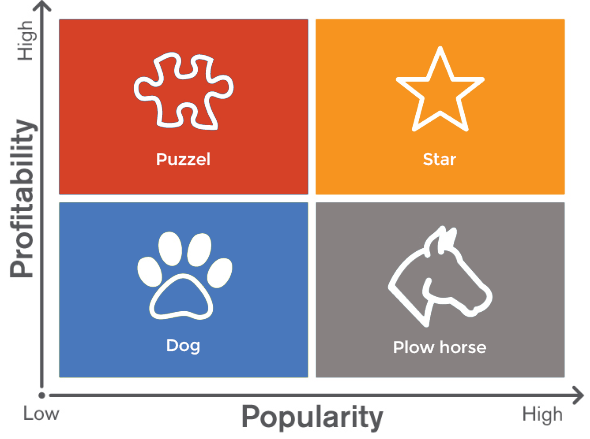

Early versions of supplier scorecards were largely focused on operational metrics and did not scale up to meet the needs of Joint Business Planning or driving long-term supply chain goals and partnerships. Commonly vendor scorecards in the retail industry track year-on-year data for sales, fill rate, in stock performance and days and weeks of inventory on hand. They present a snapshot of this year’s (TY) data against last year’s (LY) and actuals against planned figures. Some other traditional metrics include margins, inventory turns, and gross margin return on investment (GMROI).

Scorecards also track qualitative metrics such as whether the goods delivered matched quality standards, orders are complete, on time, if there are any damaged or un-saleable goods and whether ASN labeling, invoice, receipts and documentation is complete and accurate.

A close look will reveal that most of these metrics are focused on short-term, tactical aspects of the business and are designed from a retailer-driven perspective. The end goal of these scorecards does not go beyond vendor compliance and definitely do not strive for collaborative culture in the supply chain.

Vendor score cards: Building Strategic Supplier Partnerships

Designed and used appropriately, scorecards can be the glue that drives and binds Joint Business Plans – an essential requirement for strategic and collaborative supplier partnerships. They can form the basis for managing closer ties between suppliers and retailers; support intensive co-ordination and foster superior collaboration at every level in the supply chain.

For this, vendor scorecards have to be designed with a shared focus on retailer and supplier goals – the retail shopper. Retailers need to recognize that traditional metrics must be supplemented with a range of indicators focused on customer centered processes and in alignment with strategic supplier relations.

- Sales

- Fill rates

- On-time delivery

- Quality of goods and services

- Service capability and performance

- Price-competitiveness

- Compliance with contract terms

- Response

- Lead time

- Technical capability

- Environmental, health, and safety performance

Vendor scorecards should include partnership metrics that track the supplier’s alignment with the retailer’s business goals and the suppliers level of cost-competitiveness and innovation. These metrics should also focus on joint supplier-retailer initiatives and improvement, collaborative education and training, and improvements to technology. A range of customer-facing metrics can help to measure the impact of the supplier’s performance on the retailer’s customers and monitor the effect of processes and operations keeping the shopper in the centre-stage. These include metrics such as perfect order, stock outs, shelf-level fill rates and customer experience index. Scorecards need to also focus on merchandising and supply chain-related metrics that track the supplier’s responsiveness and support for promotions and seasonal events. Finally, no score card is complete with the standard compliance metrics that track a supplier’s capability to meet performance criteria, support retailer operations and adheres to agreements and guidelines.

An effective scorecard will lead to more strategic supplier relationships, and it will reinforce those processes and attributes that are most important for the retailer. Retailers increasingly are recognizing that comprehensive scorecards can provide a clear competitive advantage in building the right kind of supply chains.