Coffee’s good for you one day; it’s chamomile tea, the next! Shoppers who wanted zero trans-fat foods and no-fat cookies on a shopping trip, come back looking for old-fashioned butter cookies and chocolate wafers, the next time. From baked snacks to herbal teas, vegan to organic, there’s no telling what the shopper in the aisle will demand.

Rapidly changing customer tastes are just one of the factors keeping CPG manufacturers on their toes. Operating in a fiercely competitive marketplace, they are fighting for scarce shelf-space and customer wallet share. They need to respond quickly to competitor promotions and pricing, comply with stringent retailer demands

– all the while striving to deliver new product innovations that stand out amidst the clutter.

The new mantra for supplier collaboration: Retail data-sharing

After initial reservations about it, retailers have now been providing their top suppliers with their POS, sales and stock data as a means of initiating supplier collaboration with them. The tangible benefits of such shared downstream data insights became evident with Walmart’s success – its Retail Link downstream data sharing platform is the pioneer in this area. Soon others like Carrefour, Metro, Tesco and Sainsbury followed suit, with proprietary extranets that passed on retailer data to their suppliers – laying down a strong foundation for supplier collaboration.

However, until recently suppliers themselves were not quite sure how this retailer data could benefit them. That is changing now. Applying the latest analytics tools and techniques, they are gaining invaluable insights and retailer-supplier collaboration from downstream data to drive their business. Many CPG manufacturers like P&G, Nestle and Unilever are using retailer data to forge a stronger foothold in retail outlets, consolidate market-share and increase margins. In many cases, the insights gained are enabling suppliers to adopt a consultative role with retailers, offering them valuable inputs on category management, as well as assortment, planogram and promotion decisions.

Perfecting in-store fill rates

Demand driven replenishment

In the traditional approach to replenishment, retailers simply provided suppliers with information on warehouse withdrawals (products pulled from Distribution Centres (DCs) to stores). There was no visibility offered into retail store-level data or current and expected consumer demand.

As a result, suppliers were largely reacting to customer orders. This often led to a mismatch in store fill rates or excess inventory at Distribution Centres (DCs) – not a great situation, either way, for manufacturers.

Del Monte’s replenishment model is an exception to this. The company made a go at shelf-level collaboration with its retail customers by drilling into their store level POS, inventory and sales data. The $3.4 billion producer of branded food and pet products relies on current store level demand data and enterprise volume forecasts to fine-tune its replenishment from factory to retailer DCs. The strategy paid off. Del Monte achieved 99% improvement in store fill rates, reduced safety stock and freed a substantial part of its working capital. It offers unmatched service to retail customers and topped the charts as the best supply chain vendor according to many industry bodies.

Soft drinks major PepsiCo has moved to a consumer driven supply chain with Food Lion. The soft drinks major is proactively fine-tuning its replenishment based on current and expected consumer demand, inventory and sales at Food Lion stores as opposed to simply reacting to goods pulled from Food Lion warehouses.

Leaner, fresher stocks – that never run out

Better inventory management

Managing the right inventory volumes at different levels of the supply chain is a key concern for all CPG manufacturers and suppliers. If they do not have visibility into retailer inventory data at stores, Distribution Centres and ‘in transit’ they stand the risk of Out of Stock (OOS) situations. More often, however, they are over cautious and end up with excess ‘safety stock’, resulting in high labour costs, warehouse expenses and working capital blocked in high inventory.

Harnessing granular retailer data on inventory can help suppliers and manufacturers to map stores to DCs, match deployed stocks to shelf gaps and reduce safety stocks. In segments such as Food & Beverages and Grocery retail, where shelf-life is critical to the quality and saleability of products, this is an even greater need.

Kellogg’s uses downstream data from Food Lion’s ‘Vendor Pulse’ platform, including item stratification and inventory tracking reports, to streamline stocks at every point in its supply chain. By integrating the stock data at Food Lion into its inventory processes, Kellogg’s reduced excess inventory at its Distribution Centres by 17% and cut inventory older than 60 days from 15% to 6% in three months.

Cross-selling through the market basket

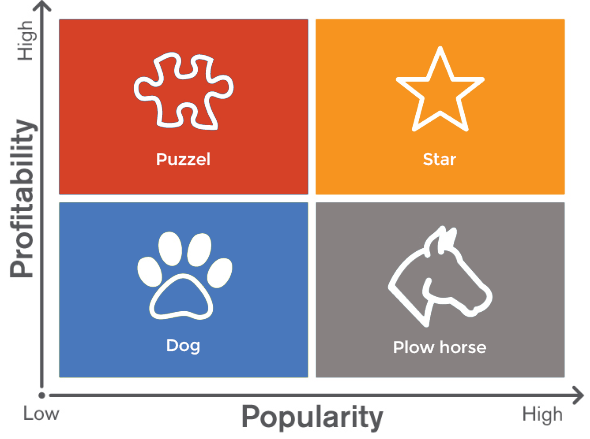

Effective Category Management

Manufacturers with a wide array of product categories and brands have to fight for scarce shelf space and facings. Needless to say, even the best brands may end up losing the fight for customers’ share of mind – or to their shopping baskets.

Leading food manufacturer Kraft solves this challenge by tying in retailer data inputs to its in-store marketing strategies.

Some of Kraft’s successful campaigns based on retailer basket views include pairing its Philadelphia Cooking Creme with a retailer’s meat department promotions and installing Parmesan Cheese racks on frozen-pizza doors at another retailer’s outlets. Kraft also used shopper trends and market basket data to innovatively display its salad dressing, pre-cooked bacon and cheeses alongside retailers’ fresh produce, making it the first choice for shoppers picking up ingredients for salads.

Going by total basket size (revenue, margin and number of items), store traffic, share of wallet and shopper loyalty trends, Kraft has been extremely successful in planogram and category management, earning it top honours in Kantar Retail’s Category Leadership Benchmarking Study.

More retailers are demanding proactive supplier collaboration through insights from store-item-day level data shared on a real time basis. Suppliers are also seeing vast improvements across their business processes including planogram management, joint business plans, collaborative product development, promotion planning, private label product management, traceability and product recall functions as well as supplier performance reviews and service levels in stores.

Mining retailer’s downstream data: Analytics for better insights

Retailer data is of little use to suppliers, unless put through the analytics scanner. Many smaller suppliers, particularly in grocery and mass merchandise segments, lack the expertise and resources for this level of analytics to be performed on POS data. To tackle this, large retailers share an array of ready reports and dashboards with them – focused on the main KPIs and metrics relevant to suppliers. On the flip side, many large CPG manufacturers are becoming ‘data czars’ – investing time and resources into building analytics capabilities. They are moving beyond the role of mere ‘order takers’ to becoming true ‘business partners’, advising their retail counterparts on a wide range of business decisions for mutual benefit.

Are you using your data mines to start a dialogue with your suppliers and drive supplier collaboration? Do they actively seek insights and share strategies based on the downstream data you share with them?