How to Assess Your Data Requirements When Implementing a Customer Data Platform

This article is part of our CDP series. To read other articles in this series, click here.

Customer data is no longer just an analytics requirement, or something used to send out marketing messages – it is the source of critical competitive advantage for a B2C business.

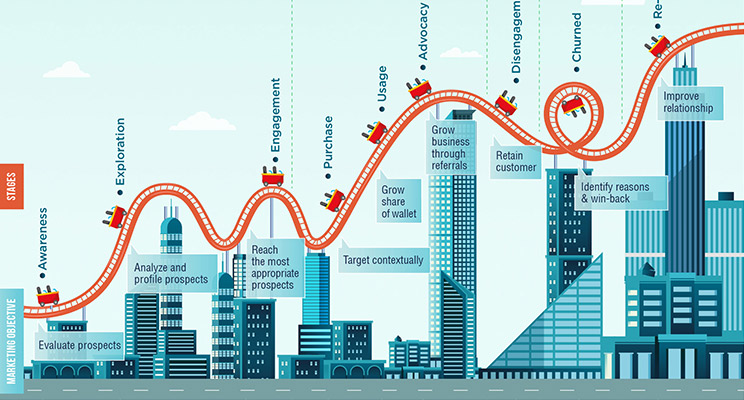

Truly customer-centric organizations use customer data for all aspect of business – from guiding product roadmap and categories, designing rich experiences, pricing their offerings right, creating the right customer service interfaces, deciding sales channels and even to make the right hiring decisions. Modern marketers use these customer insights to form a unified understanding of every customer and create contextual experiences that strengthen the relationship with the customer, ensuring loyalty and higher word of mouth.

Every company today collects more data about their customers that they use. They can also easily acquire additional, reliable data from data companies, and each byte presents insights that were not available before.

As a first step when deploying a Customer Data Platform (CDP), know what use cases you want to enable – this decides what data needs to be brought together. At this stage, assess your present data and what you need to acquire. Controlling customer churn, lifecycle marketing, and marketing attribution all require certain unique data sets.

The use cases and user types will dictate the format to store data in, the frequency of refresh and ingestion (real-time or batch) data, transformation required and responsiveness.

For example, in an e-commerce retail business like Amazon, purchase history is needed to provide personalized recommendations to customers. While digital data such as web-browsing/ app-browsing, items added to cart, saved for later, searched or viewed is captured, there is value in plugging in additional information such as income bracket, size of family, lifestyle, nature of work, types of vacations taken. This provides deep insights into what the customer would like, and the customer is pleasantly surprised with the retailer’s next-best product recommendations.

Organization owned customer data from the CDP foundation

Let us start with the data you have. If you have a Customer Relationship Management (CRM) program, provide any level of customer service or have a functioning loyalty program, then you have a solid foundation for your customer data platform. The CRM and loyalty systems can provide insights about demographics, purchase behavior, loyalty, and customer lifetime value and also contain the basic identity details.

But to do this right, it’s necessary to have a single customer record across all touchpoints by removing duplicate entries and resolving mismatches, that are created due to multiple reasons: incorrect data entry, different name variations of a customer, customers with multiple loyalty cards, change in their address etc. (Read more about solving the customer identity puzzle here). After de-duplication and linking customer records, you know the real size of your customer base and have more accurate profile snapshots.

Transactional and digital data generates actionable insights for strategic gains

If your business engages your customers in more than one channel, for example through the store and e-commerce, or over mobile apps, that’s a new set of data streaming in, which can enhance your understanding of your customers. Again, it’s important to link customer IDs across different channels, functions and customer devices to have a holistic customer view, that does not vary based on who is accessing it and where.

Most businesses use outbound digital communication data for pointed interventions, but information such as search, browsing patterns, offer engagement, wish-listing, abandoned carts all tell you something about the customer.

An insight-driven organization focuses on this knowledge, rather than the data itself. If along with the CRM and loyalty data, you have these astute observations, it can power better marketing and experience strategies. Storing every click of every customer is not feasible and honestly, not required. The signals you get by analyzing these clicks, cookies, customer location, and device information during the digital engagement should be part of your CDP strategy.

External data sets to enrich customer attributes

Finally, bring in 2nd and 3rd party web, demographic, psychographic, location, buying intent data to further enrich what you know about your customers. This is the ‘test-use-evaluate and iterates’ part of your data strategy. Not all data providers are the same, they all start their data journey differently and may or may not work for your brand and your customer base. It’s also important to note that data degrades quickly – the data was good a few quarters ago might not be valid anymore. Customer interests and intents may have evolved – they may have changed jobs or had a major life-event. To find out what works for you, do small experiments with a good set of data partners and choose the one that works best for your current marketing and strategy needs.

If you are poorly utilizing the data you have captured, or not capturing certain essential data, you are losing important revenue opportunities. If data is the new oil, accurate customer insights are high octane racing fuel for your B2C business!