Menu Engineering: Real-time insights enable menu optimization

An optimal menu not only drives financial success but also enhances guest experiences. This makes Menu Engineering a key aspect of QSR strategy. With real-time insights, Operations Leaders could engineer their QSR menu to keep costs under check while ensuring customers’ favorites are firmly placed in the menu.

Personalized menu with advanced customer insights

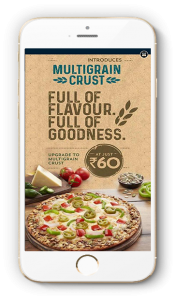

The sudden spike in online ordering through apps presents immense opportunity for QSRs to hyper-personalize customer experience. And menu personalization is a key element of the overall experience. Data on customers’ taste and preferences are collected and analyzed. Using machine learning and AI technology, the app shows users the most relevant menu items, promotions and content based on their individual preferences, past dining history, location, weather and restaurant specific menus and pricing.

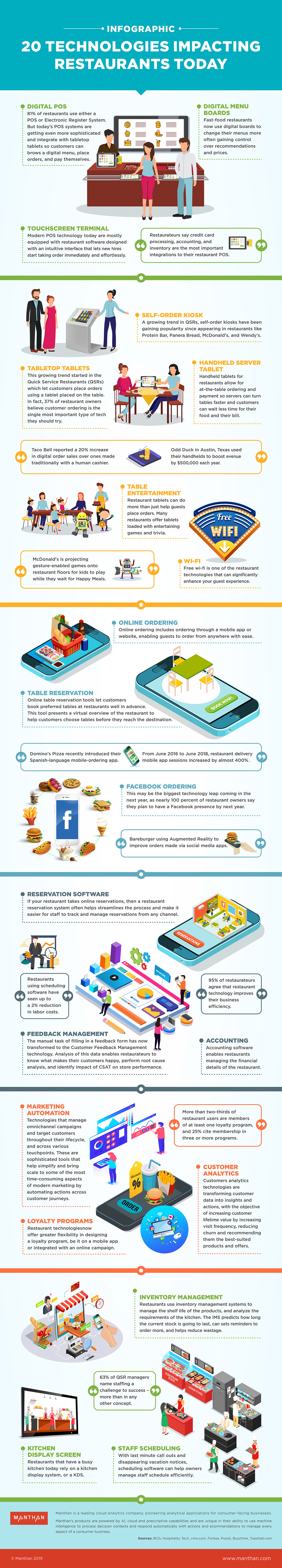

With data and intelligence, menu engineering is more science than art, in today’s times. An advanced AI platform helps you engineer your menu across outlets, reduce cost and drive loyalty. The underlying need to design optimized menus is Data – menu items, number sold, food cost, menu price. Clean and structured data on your customers, likes, preferences, transactions, affordability, menu items and their costs are some of the key inputs to the menu formula.

Advanced algorithms analyze the demand and costs of menu items to help you identify your most and least profitable menu items. AI platforms integrate with back-of-house systems to draw this data and throw up in-depth intelligence to help make smart decisions on menu and other aspects of QSR business.

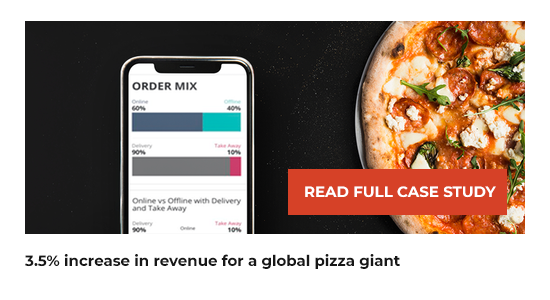

An advanced BI and Restaurant Analytics platform provides real-time insights to re-engineer your menu, forecast sales, reconcile 3rd party sales, optimize delivery time and more.

Let AI help you identify your Stars on the menu

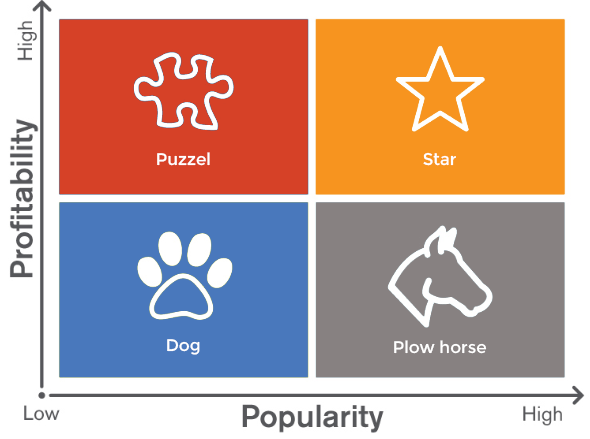

Manual menu analysis is bereft of inaccuracies and never complete. This leads to loss of revenue opportunities and impacts profitability. As alluded to earlier, data and intelligence could help identify popular menu items across stores and locations in real-time. Advanced algorithms map trends, cull out underlying reasons and recommend next best actions for menu items. For e.g., Algorithms throw up the bestselling pizza by size, day, topping, location and recommend menu combos that would help you leverage its popularity.

By adding data on item cost and profitability to sales of menu items, you can be sure to accurately identify the best and worst performing items, from your long menu list. Using this, QSRs could develop an action plan to optimize the menu by reducing low profitability items and increasing the popular ones.

Menu engineering is about managing this mix of stars, plow horses, dogs and puzzles that leads to reduced costs, improved profitability without compromising on customers’ wants. Let’s see how algorithms could help in arriving at the right menu mix.

Make your STARS shine brighter

Algorithms identify Star menu items based on factors such as sales volume, costs, price, margins, promotions, etc. They help you analyze the underlying reason and recommend ways to make the most of these popular and profitable items on your menu. AI platforms recommend:

- Other locations where these items can be introduced to enhance revenue opportunity

- Price increase by calculating the likely impact on demand

- Menu combos with other items that are lower in profitability, using association mining

Let your PLOW HORSES gallup

Algorithms are quick at identifying items that are growing in popularity. Juxtapose this data against its costs and you know whether you are heading towards the left of the balance sheet or the right. Trust the AI to do the magic – menu combos that offsets the low profitability of the item or more dishes with high priced ingredients for economies of scale. You may just end up with Star with AI-based recommendations.

AI solves the PUZZLE

With a 360-degree view of sales, marketing & operations data, AI platforms turn into Sherlock Holmes to find that missing piece of the puzzle. Run the analysis and in a matter of seconds you’ll know why they are not flying off the shelf. Turn the recommendation engine on to increase their demand. Reduce price, introduce an offer or run a campaign, these algorithms have a marketing trick up their sleeve.

Let the DOGS take a walk

While the algorithms are quick at identifying Dogs and recommending their expulsion, human intelligence needs to prevail here. For e.g., Kids’ menu is neither high volume nor highly profitable ut you may want it to stay on the menu.

Optimize QSR menu with Algorithms

Data and Intelligence are the key ingredients in dishing out a menu with the right mix of Stars, Plow horses, Puzzles and Dogs. Advanced AI tells you what’s popular and why. Likewise, it helps you understand the implications of cost and pricing. And this is a dynamic exercise as customer tastes and preferences, economic and social situation, change. With real-time access to data & insights, AI platforms help you balance high and low food costs to garner a reasonable amount of profit margin yet cater to customers’ preferences.